CO-OP Network Founded

1981 - OctoberCO-OP Network founded by a group of visionary California credit unions with 20 ATMs.

Cooperative Philosophy

1985 - AugustCO-OP Network drew upon its cooperative philosophy to create an affiliation with Star System. Consequently, CO-OP Network is the only credit union network that has a substantial equity interest in a large regional bank network.

Partnership

1986 - JuneCO-OP Network, Bank of America, Southland Corporation and EDS form a partnership with CATS/Money Quik to deploy ATMs in retail locations.

One Million Monthly Transactions

1988 - MarchCO-OP Network reaches one million monthly transactions.

Deluxe Corporation

1988 - MarchCO-OP Network signs agreement with Deluxe Corporation and redefines its organizational and contractual structure to reflect that of a network.

CU Service Centers

1990 - AugustCO-OP Network forms a strategic alliance with CU Service Centers to launch and manage that operation.

Robert Rose as President and CEO

1990 - OctoberRobert Rose is named President and CEO of CO-OP Network.

Conference and Annual Shareholders Meeting

1992 - AprilCO-OP Network sponsors its first Conference and Annual Shareholders’ Meeting in San Diego, Calif.

Four Million Monthly Transactions

1993 - MayCO-OP Network reaches four million monthly transactions.

Credit unions from San Diego Trust

1994 - FebruaryCO-OP Network acquires more than 60 credit unions from San Diego Trust

5 Million Monthly Transactions

1994 - MayCO-OP Network reaches one million monthly POS and five million total transactions at 700 ATMs

Stock Offering

1994 - NovemberInitial stock offering is made

CO-OP Becomes a Cooperative

1996 - AprilCO-OP Network legally becomes a "pure cooperative".

CO-OP Network and Service Centers Corporation Merge

2002 - JuneCO-OP Network and Service Centers Corporation finalize their agreement to combine and operate two lines of business: EFT and Shared Branching. Nearly 700 SC24 ATMs will be re-branded by CO-OP Network during the next 24 months and SCC will continue directing its multi-state shared branching entity as a separate subsidiary of the new organization.

New Corporate Name

2006 - MayCO-OP Financial Services becomes the new corporate name. No longer solely a network, the new name reflects an expansion of services that now includes three lines of business solutions and dozens of products.

CO-OP and CUSC Combine Shared Branching

2007 - JanuaryCO-OP and CUSC sign a letter of intent to combine shared branching operations.

CO-OP and CUSC Finalize Agreement to Form CO-OP Shared Branching

2007 - JulyCO-OP and CUSC (Credit Union Service Corp.) finalize an agreement to form CO-OP Shared Branching, which represents 80 percent of the country's shared branch participants.

CO-OP Hosts THINK 2008 with Speakers from Apple and Pixar

2008 - MayCO-OP hosts "THINK 2008" which includes an all-star lineup of speakers from Apple, Burger King, Starbucks, Southwest Airlines, Pixar, Brandweek, and Harley-Davidson, who share ideas, insights and innovations with record number of attendees.

CO-OP Acquires The LoanLink Center from CUNA Mutual Group

2009 - NovemberCO-OP acquires The LoanLink Center from CUNA Mutual Group, in a deal announced the previous month. CO-OP rebrands the operation as CO-OP Member Center, offering LoanLink Services and Member Services.

CO-OP and FSCC announce Intent to combine operations

2011 - SeptemberCO-OP and Financial Service Centers Cooperative, Inc. (FSCC) announce that the Board of Directors of the two companies have approved a letter of intent to combine operations, unifying credit union shared branch services. The agreement closes on the last day of the year, Dec. 31.

CO-OP Announces NCUA has approved purchase of Corporate Network eCom

2011 - DecemberCO-OP announces that the National Credit Union Administration has approved its intent to purchase the online and mobile bill pay services of Corporate Network eCom, LLC, a subsidiary of the U.S. Central corporate credit union. (Finalized in February 2012).

TMG and CO-OP form partnership

2012 - JanuaryThe Members Group (TMG) and CO-OP announce they have formed a partnership and that CO-OP has made a strategic investment in TMG. Both companies will cross-sell all of their respective products and services.

CO-OP becomes minority owner of Finivation

2013 - AugustCO-OP becomes a minority owner of Finivation, strengthening an existing technical partnership for Web and mobile application development and the related middleware to efficiently connect hosts and acquirers for emerging CO-OP products.

CO-OP and Alkami Technology form partnership

2014 - FebruaryCO-OP and Alkami Technology, Inc., are partnering to bundle CO-OP Bill Pay with the Alkami ORB Platform, enabling credit unions to offer members a fully-integrated online and mobile banking bill payment solution.

CO-OP Purchases Covera Solutions from NYCUA

2015 - FebruaryThe New York Credit Union Association (NYCUA) announced it has signed a letter of intent from CO-OP Financial Services to purchase its subsidiary, Covera Solutions, Inc. Covera currently provides 248 credit unions and their members with credit, debit, ATM and prepaid card solutions. The purchase was completed at the end of April 2015.

CO-OP signs agreement to purchase Everlink Payment Services

2015 - AprilCO-OP signed an agreement to purchase from a subsidiary of Fidelity National Information Services, Inc. (NYSE: FIS) its shares in Everlink Payment Services, Inc., giving CO-OP majority ownership of the Canadian payments solutions and services provider to credit unions, banks and ISOs in Canada. CO-OP joins minority-owner Celero Solutions (www.celero.ca) of Calgary, Alberta, as the two shareholders of Everlink. The deal closed on April 30, 2015.

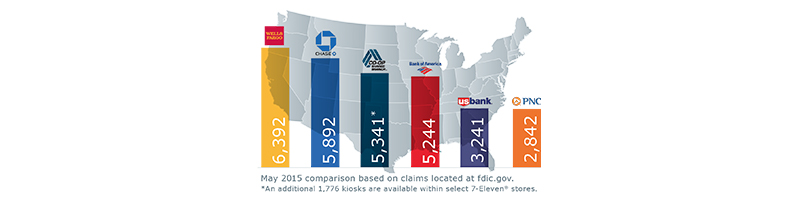

CO-OP Shared Branch surpasses Bank of America in number of Branch Offices

2015 - JuneCO-OP Shared Branch has surpassed Bank of America in number of branch offices, and is now the nation's third largest network of financial institution branches, according to data drawn from the FDIC. By January 2016, the network reached 5,400 branches.

CO-OP surpasses 3 billion EFT and shared branch transactions

2016 - JanuaryCO-OP established a new annual record in 2015, processing 3.2 billion electronic funds transfer (EFT) and shared branch transactions by credit union members, an increase of 6.6 percent compared to 2014.

CO-OP Announces highest annual dividend ever by a CUSO

2016 - AprilCO-OP announced a patronage (shareholder dividend) pool of $53.3 million for 2015, the highest annual dividend ever recorded by a CUSO for its owner credit unions. The shareholder patronage for 2015 raises to $367.9 million the total patronage amount made available by CO-OP since becoming a cooperative in 1996. The $53.3 million patronage is partially the result of the company's sale during 2015 of most of its investment in Ensenta Corporation.

Todd Clark becomes President and CEO of CO-OP

2016 - JuneFollowing a nationwide search, Todd Clark became the new President/CEO of CO-OP effective June 27, succeeding the retiring Stan Hollen. Clark had most recently served as SVP/Head of STAR Network and Debit Processing for First Data Corporation, where he had full profit and loss responsibility for the EFT Group.

CO-OP acquires TMG

2017 - AprilThe move unites CO-OP, the leader in debit processing and network delivery, and TMG, the leader in credit processing, under one management team. The combination adds up to a “dream team” of the payments and financial services industry.

CO-OP Shared Branching

2017 - AugustCO-OP Shared Branching becomes the second largest retail financial services network in the U.S. The credit union network added more than 400 branches in the past two years, and is less than 500 locations away being the largest. In early 2018, the network had surpassed 5,700 locations total.

Co-Creation Councils Formed

2018 - JanuaryCo-creation Councils launched in the New Year. The three councils represent the evolution of client advisory teams that had been in place at CO-OP and TMG prior to the consolidating of the two companies in April 2017. The relaunched councils of the one, united CO-OP include the Strategy Co-creation Council, Solutions Design Co-creation Council and Experience Co-creation Council.

CO-OP unveils MyCO-OP

2018 - FebruaryCO-OP unveils MyCO-OP, a new client portal that will provide credit unions with secure, universal access to CO-OP applications through a single, highly intuitive user interface.

CO-OP introduces COOPER

2018 - MayCO-OP introduces COOPER, an advanced data-driven platform designed to detect and fight fraud faster than ever before, bringing more visibility to member activity and needs. COOPER is designed to ultimately bring state-of-the-art machine learning and artificial intelligence to its client credit unions across the CO-OP ecosystem.

New Annual Record Set for Total Transactions

2019 - JanuaryThe combined forces of CO-OP and TMG, acquired in April 2017, led to a new record number of payment transactions processed by CO-OP: 7.1 billion during 2018.

COOPER fraud analyzer Goes Live

2019 - FebruaryCO-OP announces that COOPER Fraud Analyzer is now part of CO-OP Shared Branch services to participating credit unions, with all network transactions flowing through the interface of this account-based risk management solution.

Financial Wellness and Support

2020 - JanuaryCO-OP continued to give back to the credit union community – in 2020, the company donated $1.7 million to the credit union system and charities.

Experience Centricity and Technology Delivery

2020 - March- CO-OP Contact Centers played a key role in member services, especially at the on-set of the pandemic. Technology enhancements enabled CO-OP to maintain high service levels while reassigning large numbers of staff to remote working and handling increased call volumes.

- The enhancements to CO-OP Contact Centers contributed to a large client reporting a record high Net Promoter Score in member satisfaction.

- CO-OP’s Enterprise Technology and Services increased its output of technology upgrades and releases by 44 percent in 2020, greatly advancing the digitization of company processes.

- COOPER Fraud Analyzer, CO-OP’s machine-learning fraud prevention and detection tool, completed its second year of service on behalf of clients.

- CO-OP THINK delivered record credit union engagement, including the “The Payments Playbook” and nine virtual events to bring new strategies to clients.

Sound Corporate Performance

2020 - December- Even in difficult market conditions brought on by the pandemic the company finished with sound, debt-free financial performance.

- CO-OP broke sales records in new client contracts and the growth of card processing clients.

- The company added new talent, from data scientists and technologists to contact center agents, fueling the company’s innovation and future vision.

- Solutions and insights made available from CO-OP included services designed to deepen member engagement and help credit unions build an interoperable payments platform.

.ashx?h=310&w=552&la=en&hash=BAD3E3C77823B4318C20FFB3A783FB73)